Open enrollment for the Particular person medical insurance marketplace for 2024 begins November 1st, and it’s time to start out interested by your healthcare protection for the upcoming 12 months. Policyholders have the chance to evaluate their 2024 medical insurance choices. This can be a essential time so that you can evaluate your protection because of the statewide premium improve of 9.6%. The rise was attributed not solely to the persistent surge in healthcare utilization post-pandemic, but additionally to larger pharmacy bills and inflationary impacts inside the healthcare sector, similar to escalating prices of care, labor shortages, and wage and wage raises. Policyholders may also replace their private info in addition to their earnings. Your current well being plan will likely be renewed routinely if you happen to make no modifications until said in any other case. Key dates to recollect: the enrollment interval for 2024 runs from November 1 to January 15.

Coated California

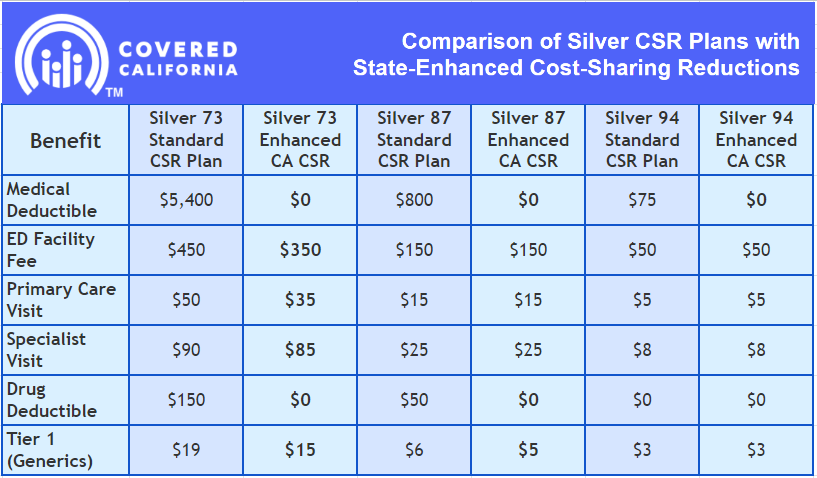

In 2024 Coated California provides Californians whose incomes are not more than 250% of the federal poverty degree to be eligible for 3 silver plans that can require no deductible. These are family earnings of at the very least $33,975 for a person and $69,375 for households of 4. Learn all the main points within the full article right here.

Right here’s the Comparison of Silver CSR Plans with State-Enhanced Price-Sharing Reductions

Furthermore, in all three Silver CSR plans, deductibles will likely be solely eradicated, thereby eradicating a possible monetary impediment in relation to accessing healthcare and streamlining the method of choosing a plan. As well as, different advantages will range by plan. Nonetheless, they’ll embrace a discount in generic drug prices and copays for main care, emergency care, and specialist visits, and a decreasing of the utmost out-of-pocket value.

Oscar Well being

Oscar will not provide particular person insurance coverage within the California market. Consequently, people who’re policyholders with Oscar might want to transition to a unique insurance coverage service for his or her protection. Moreover, policyholders ought to diligently examine different insurance coverage choices to safe steady well being protection.

Blue Protect of California

Blue Protect serves greater than 3.4 million members and has nearly 65,000 physicians throughout the state. It provides HMO and PPO plans. The HMO Trio has a strong main care physician community with the Windfall system (St. John Hospital, St. Joseph, Windfall Cedars Tarzana, Entry Medical Group Allied Pacific, UCLA, and Cedars will not be within the community). The PPO protection has an in depth community with self-access to many UCLA, Cedars Sinai, and Windfall docs. Premium prices, nevertheless, will improve to 15% in 2024.

Anthem Blue Cross

With over 8.6 million members in California alone, Anthem Blue Cross covers extra Californians than some other service within the state. Anthem’s broad supplier community consists of over 65,000 care suppliers in California. Alongside the Windfall System, Axminster, Allied IPA, and others—nevertheless, not UCLA and Cedars. Their premium fee improve in 2024 is 10.9%.

Well being Web

In 2022, Well being Web’s particular person and household plans (IFP) could have a brand new title, Ambetter from Well being Web. Out there in most counties in California, they provide HMO, EPO, and PPO plans. Their PPO plans don’t contract with UCLA or Cedars Sinai, however they permit self-referral to the Windfall system and different suppliers. Premium prices will improve to 8.4% in 2024.

Kaiser Permanente

Kaiser serves greater than 10 million members, provides HMO protection with the Kaiser System, and consists of entry to Kaiser hospitals. They personal the amenities, they usually do rent docs. Their premium fee improve in 2024 is 7.4%.

LA Care Coated

L.A. Care provides HMO plans with entry to the UCLA system and, relying in your zip code, the Windfall system, Optum, Prospect IPA, PIH, and extra. Premium prices will improve to 6.1% in 2024.

Please learn our weblog to take a look at different supplier choices in California and their premium improve expectancy for 2024.

At Strong Well being Insurance coverage, we ease the complexity of the person insurance coverage market. We discover a well being plan that matches your price range and your medical wants, whether or not you’re contemplating renewing your present plan or looking for a brand new one. It’s necessary to know that not having medical insurance can result in a tax penalty. Preserve this in thoughts while you’re deciding in your healthcare protection to keep away from any additional prices.

You could name us at 310-909-6135 or e-book an appointment. We’d be completely satisfied to reply your questions on your medical insurance so you may make well-informed choices about whether or not it’s your particular person, household, or small enterprise’s protection.